Business Insurance in and around Longview

Calling all small business owners of Longview!

Helping insure businesses can be the neighborly thing to do

State Farm Understands Small Businesses.

Operating your small business takes dedication, commitment, and excellent insurance. That's why State Farm offers coverage options like a surety or fidelity bond, errors and omissions liability, business continuity plans, and more!

Calling all small business owners of Longview!

Helping insure businesses can be the neighborly thing to do

Cover Your Business Assets

When you've put so much personal interest in a small business like yours, whether it's a gift shop, a sign painting company, or an antique store, having the right insurance for you is important. As a business owner, as well, State Farm agent JJ Walnofer understands and is happy to offer personalized insurance options to fit your business.

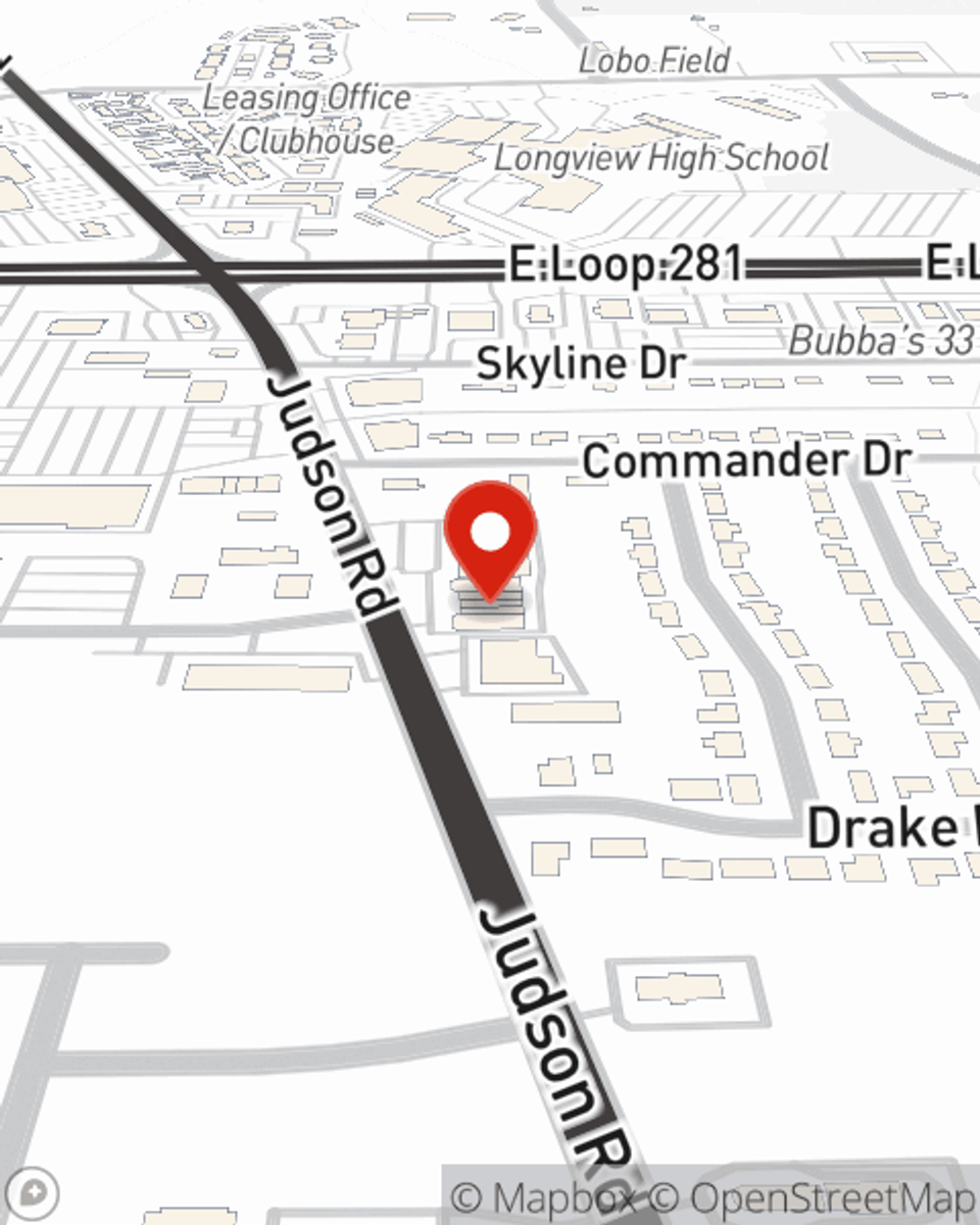

Call JJ Walnofer today, and let's get down to business.

Simple Insights®

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

JJ Walnofer

State Farm® Insurance AgentSimple Insights®

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.